Kaoshi Network

Our digital peer-to-peer marketplace enables two-way currency exchanges between users with naira and users in the diaspora with foreign currency.

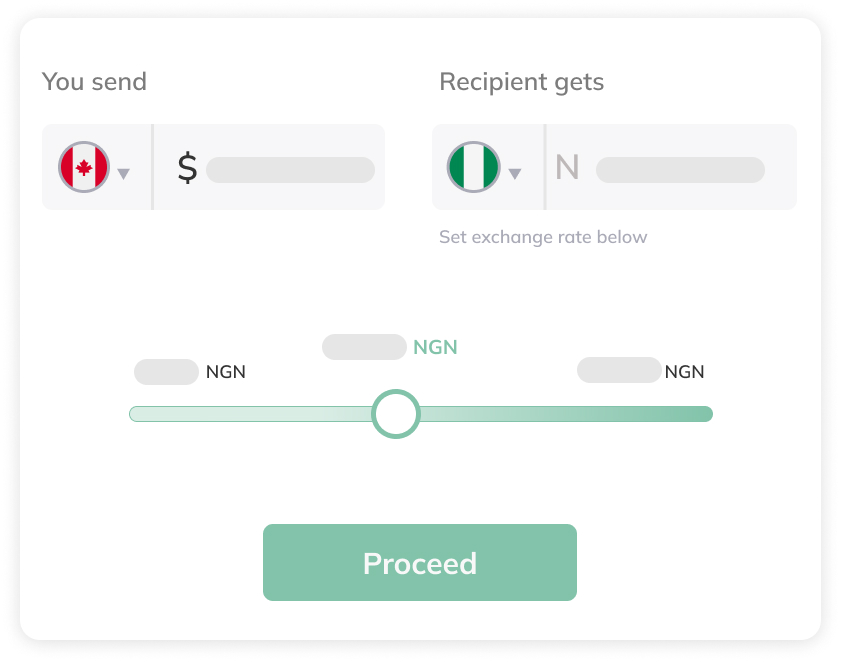

Choosing your own exchange rate

We give you the flexibility to set your own exchange rate to swap your currency (within a given rate range), giving you greater control of each transfer.

We also provide a ‘Suggested Rate’, for our users who want to swap their currencies at the prevailing market rate.

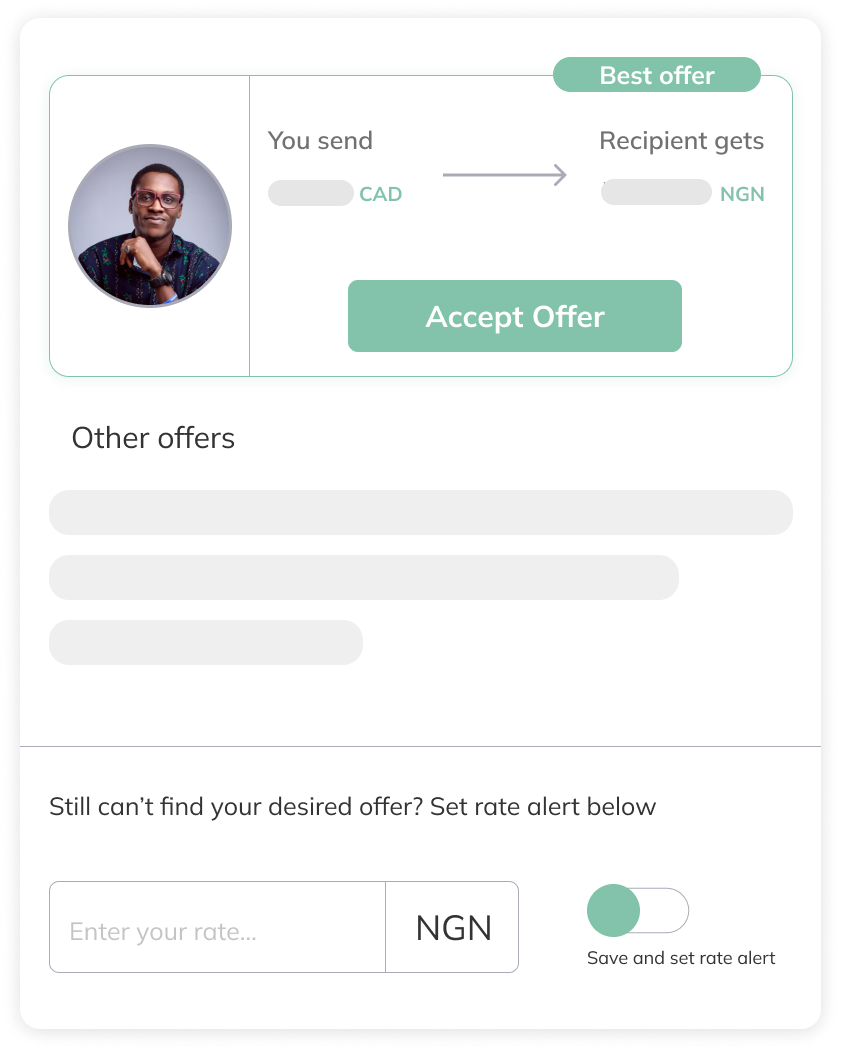

Peer-to-peer Offers

Kaoshi users can access a daily stream of live offers in the marketplace across all the currencies we enable swaps. Our marketplace allows users, shop for the best offers. i.e. The offers that guarantee that their beneficiaries receive the most money.

In the event the available offers are not within your desired rate range, just set a preferred rate, using the ‘Rate Alert’ feature, and get notified when a better offer is live on the platform.

Kaoshi User Types

There are two types of users on Kaoshi – Matchers and Posters.

A ‘Matcher’ is someone who wants to send naira to Nigeria from the diaspora. Whilst a ‘Poster’ is someone in Nigeria who wants to exchange their naira for foreign exchange (FX), in their local domiciliary account or a foreign bank account.

Account Setup

Matcher User

I want to send Naira to Nigeria from the diasporaPoster User (1)

I want to exchange Naira for foreign exchange into a foreign bank accountPoster User (2)

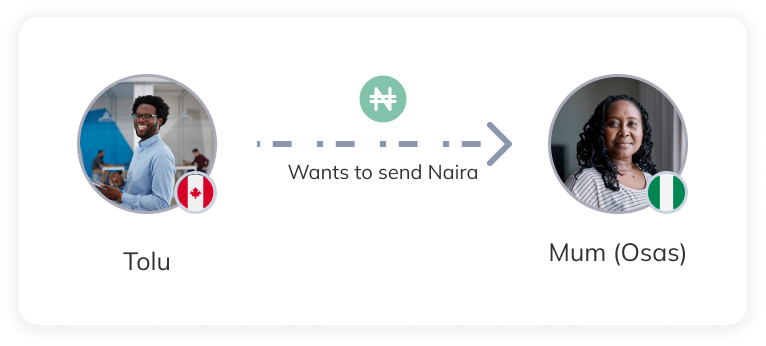

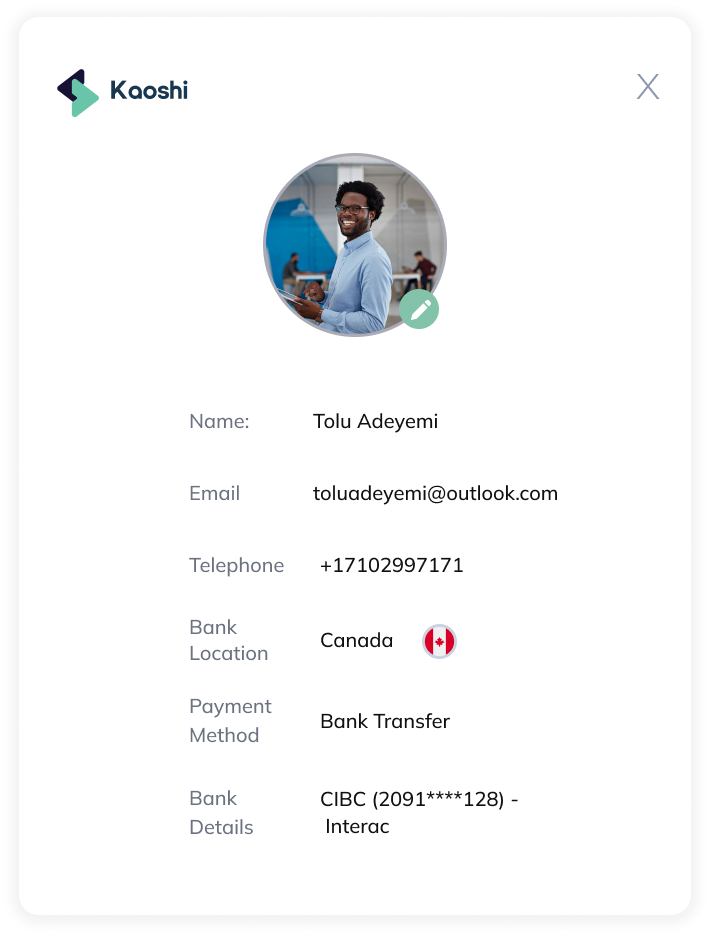

I want to exchange Naira for foreign exchange into a local domiciliary accountFor instance – Tolu lives in Canada and needs to send Naira to his mum (Osas) in Nigeria.

Tolu Creates his Kaoshi account

- Inputs contact details

- Selects Bank Location

- Enters Bank Details of Interac-enabled

bank account as payment method

Account setup for Poster 1

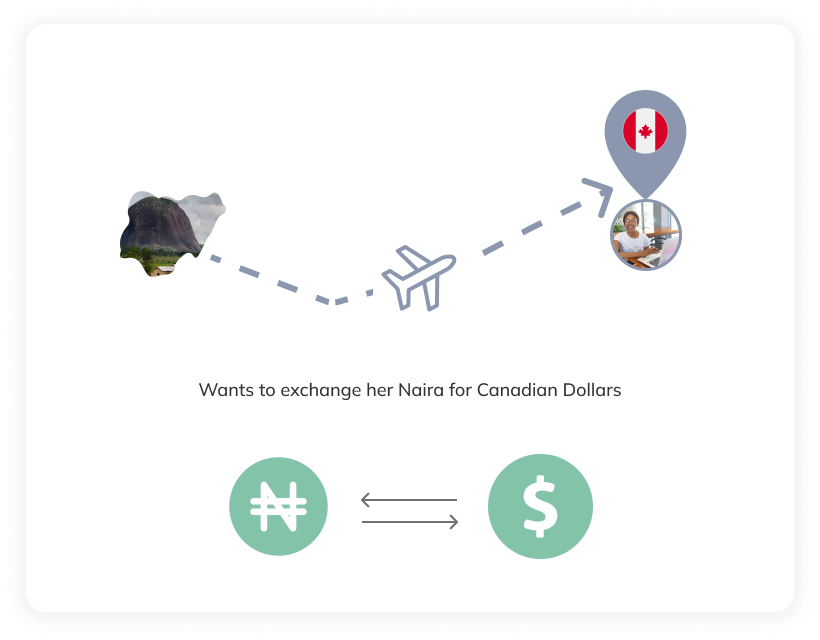

For instance – Chika just moved to Canada from Nigeria and needs to exchange her Naira Canadian Dollars (CAD)

Chika needs to create two Kaoshi Accounts:

- To send NGN from her Nigerian bank account

- To receive CAD in her Canadian bank account

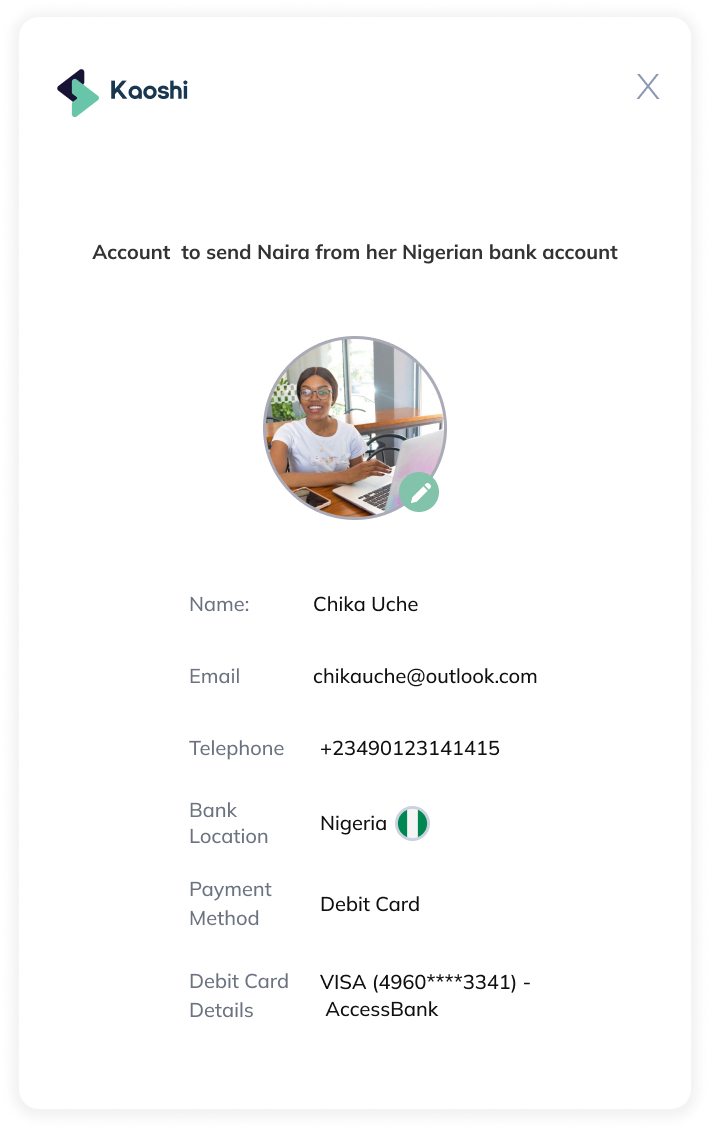

Chika Creates her Nigerian Kaoshi account:

- Inputs contact details

- Selects Bank Location

- Select Payment Method

- Enter Nigerian bank debit card details

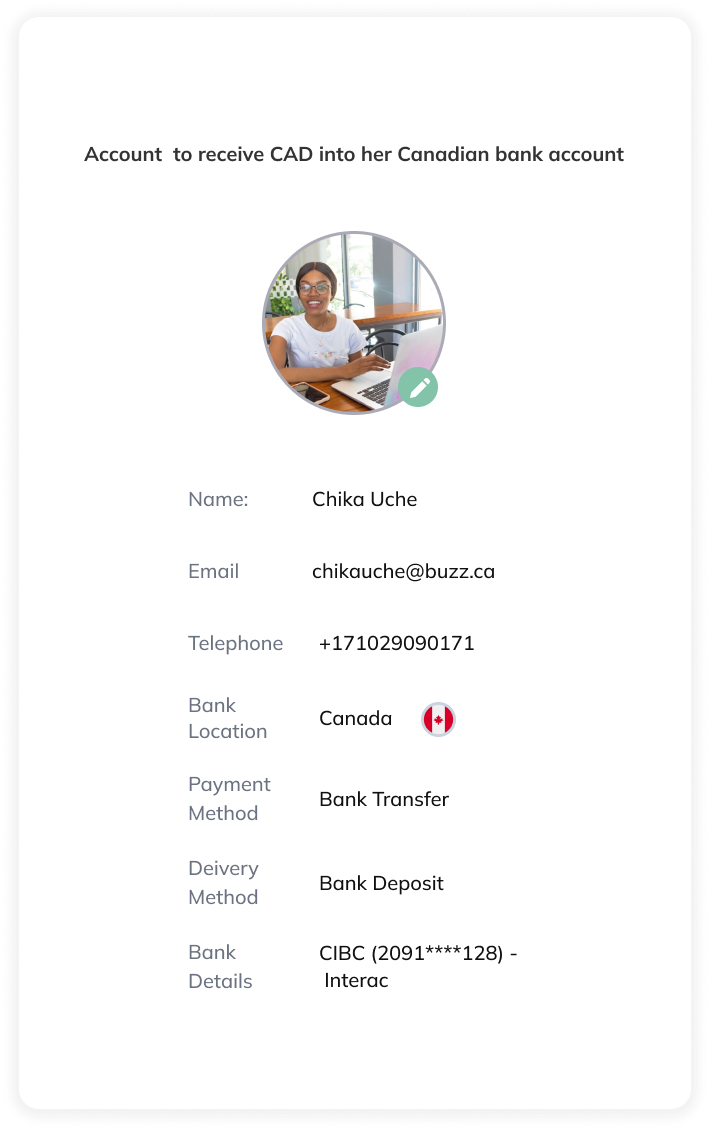

Chika needs to create two Kaoshi Accounts:

- Inputs contact details

- Selects Bank Location

- Selects Payment Method

- Selects Delivery Method

- Enter Interac-enabled bank account as the delivery method

- Enter Interac-enabled bank account as the payment method

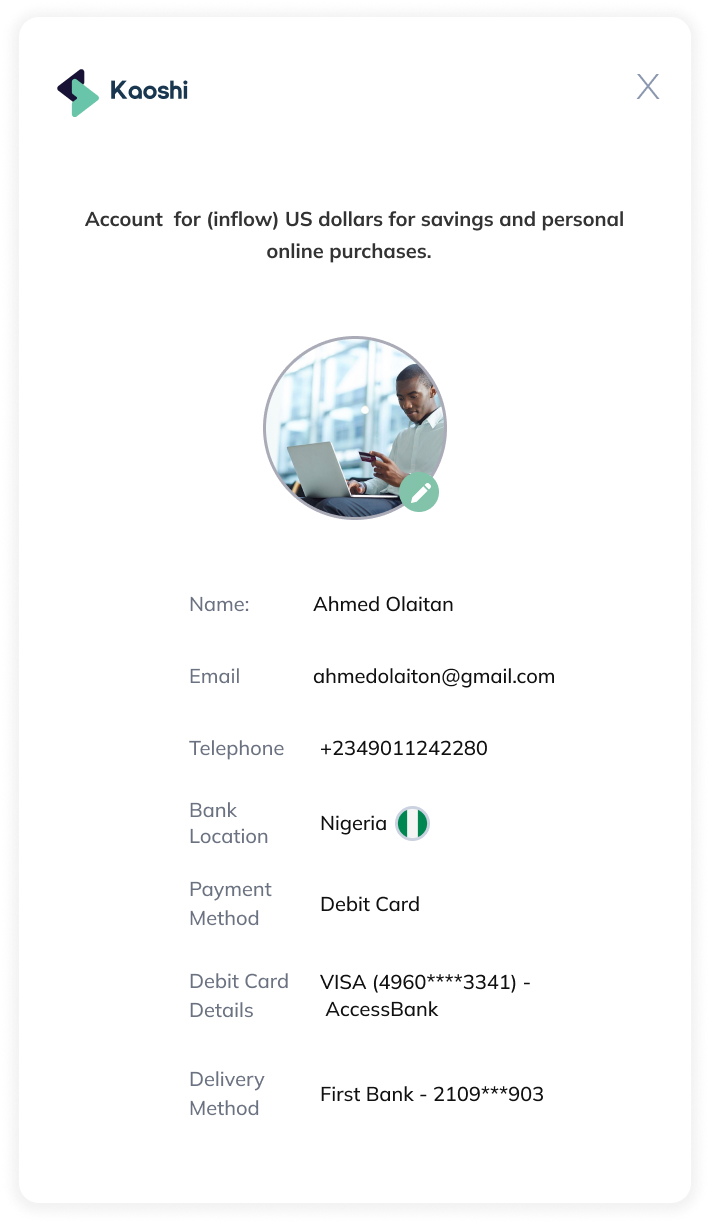

Account setup for Poster B

Ahmed is exchanging his Naira for (inflow) US dollars for savings and personal online purchases.

Account setup for Poster B

- Inputs contact details

- Selects Bank Location

- Selects Payment Method

- Selects Delivery Method

- Enter Nigerian domicilary bank account as the delivery method

- Enter Debit Card details as the payment method

How the Matcher and Poster accounts work together

Matcher User

I’m sending Naira to Nigeria from abroadPoster User (1)

I’m exchanging Naira for foreign exchange into my foreign bank accountPoster User (2)

I’m exchanging Naira for foreign exchange into my local domiciliary account

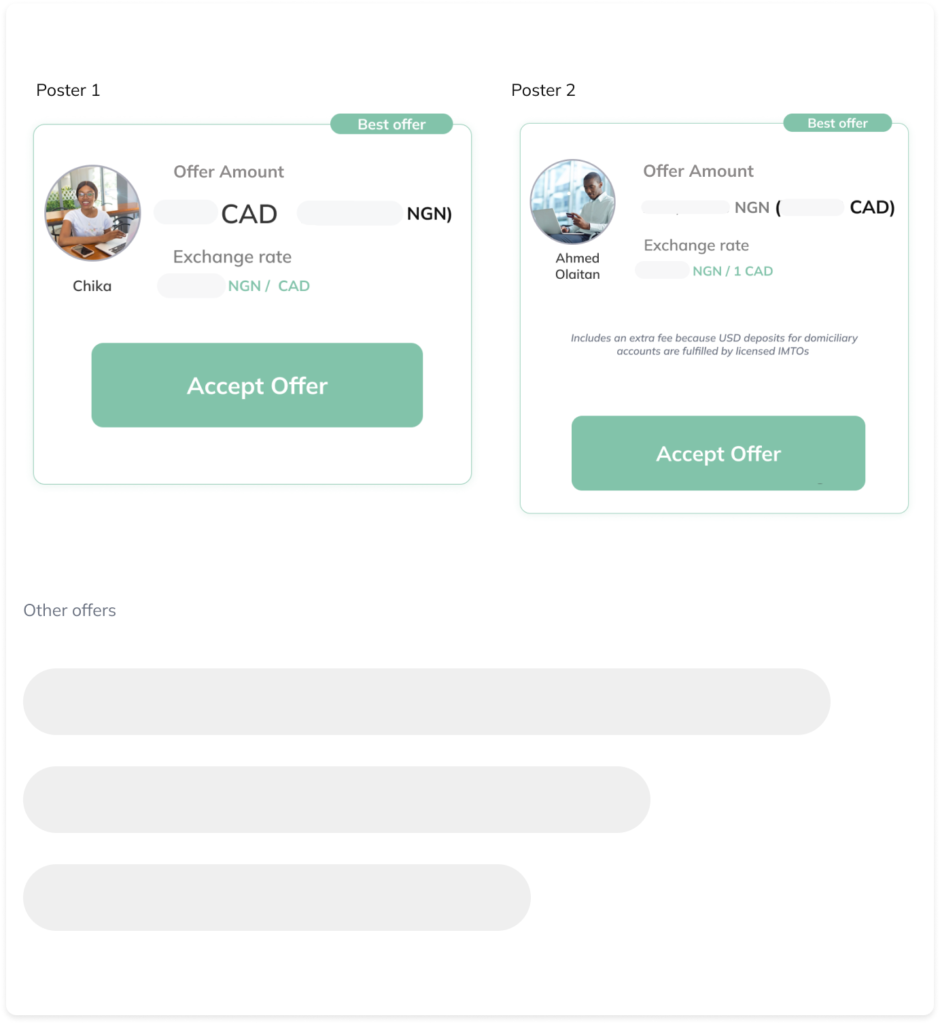

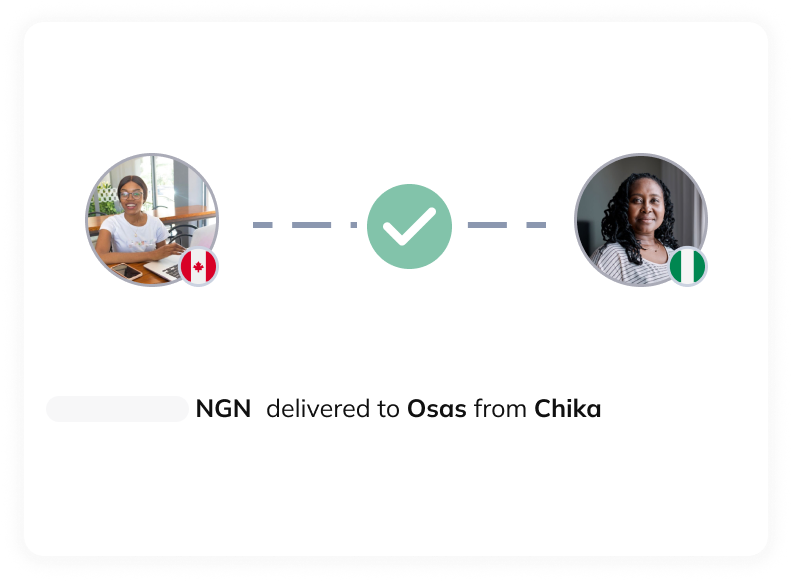

Tolu finds two offers from Ahmed and Chika, poster accounts that match his request.

Matching request with poster 1

Step 1

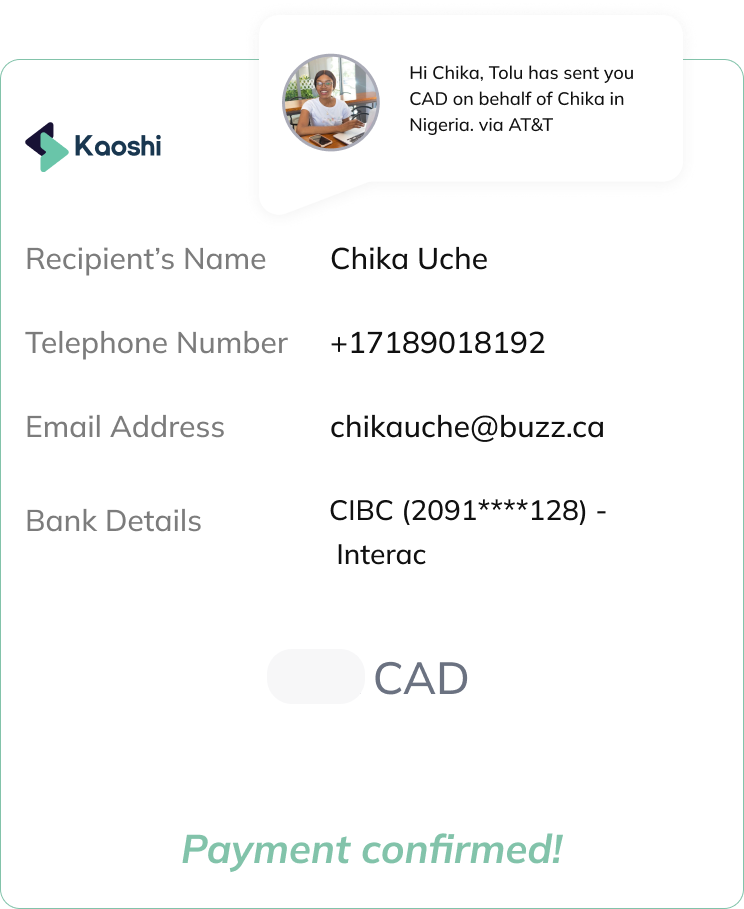

Matching Tolu’s request with poster 1, Chika, who wants to exchange her Naira for Candian dollars into her Canadian bank account.

Tolu accepts Chika’s offer

Step 2

- Tolu is prompted to make the payment to Chika’s Canadian bank account

- Kaoshi verifies the payment and payment amount

Chika receives her CAD in her Canadian bank account

Step 3

Matching request with poster 2

Step 1

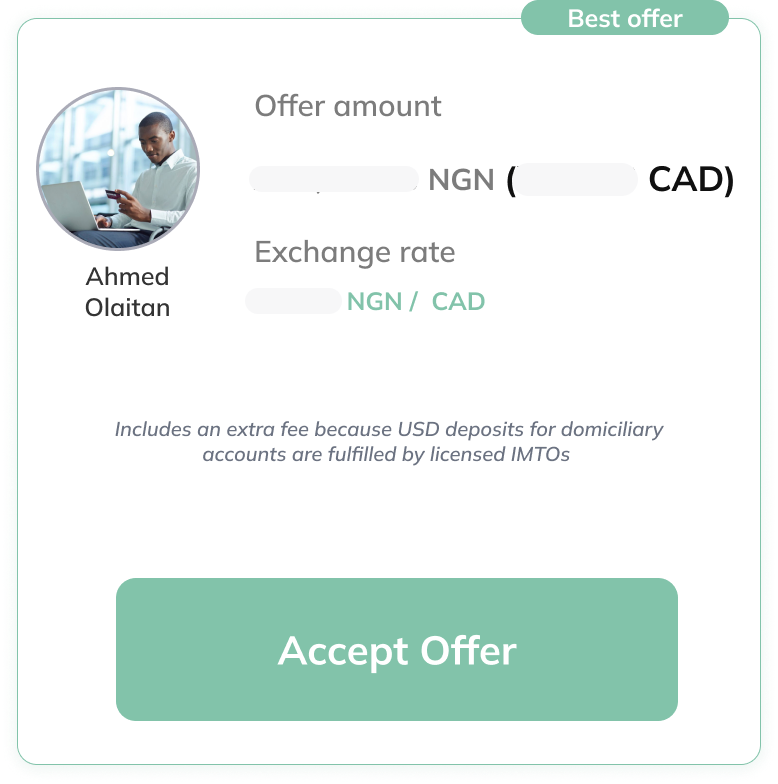

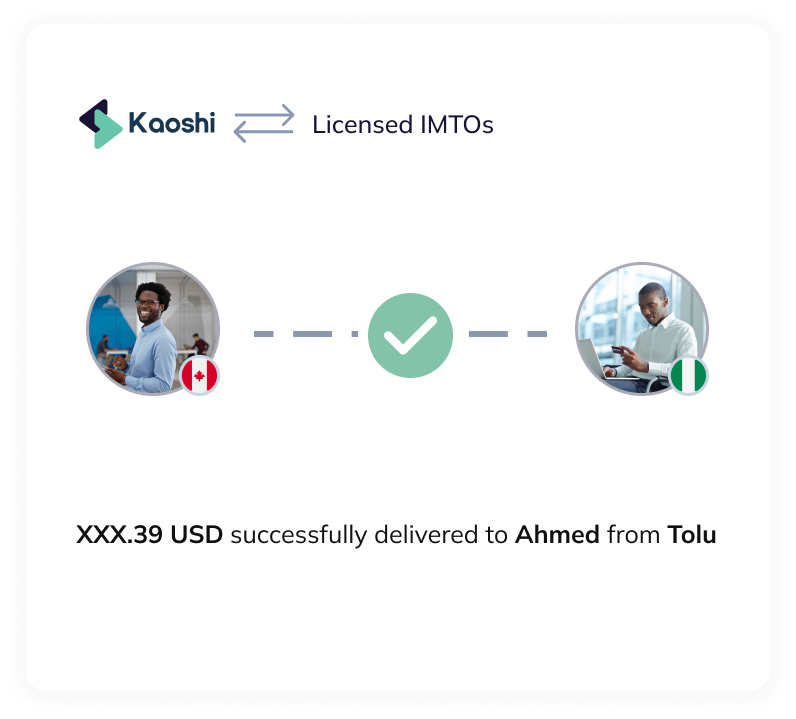

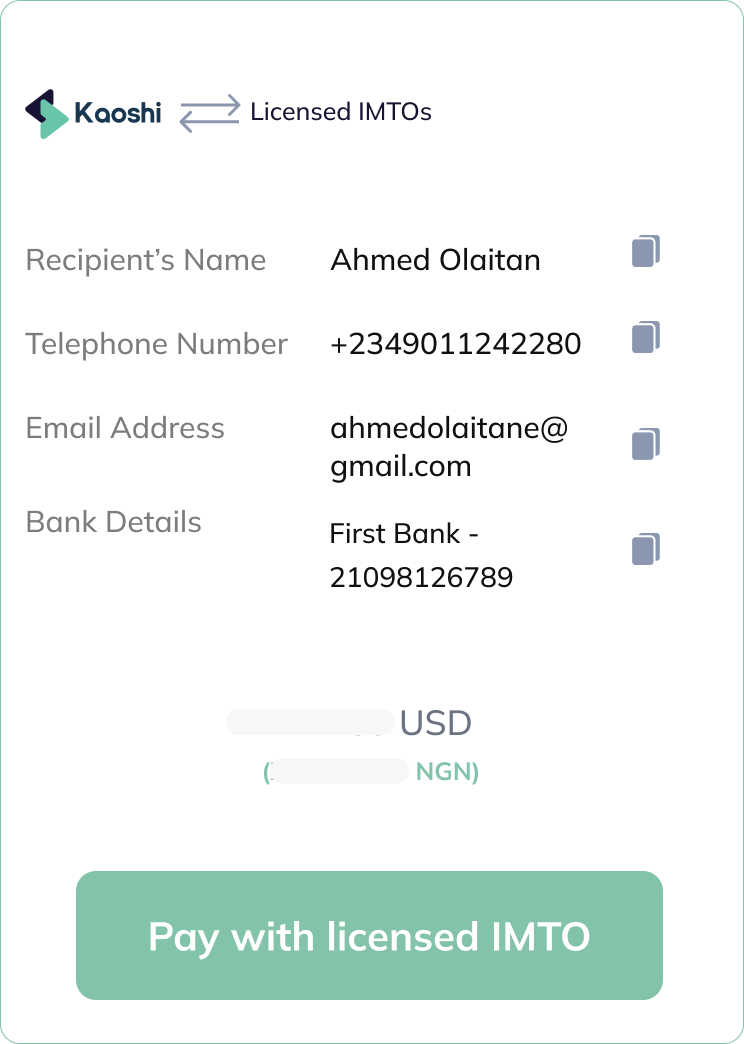

Matching Tolu’s request with poster 2, Ahmed, who wants to exchange his Naira for US dollars into his local domiciliary bank account.

Tolu accepts Ahmed’s offer

Step 2

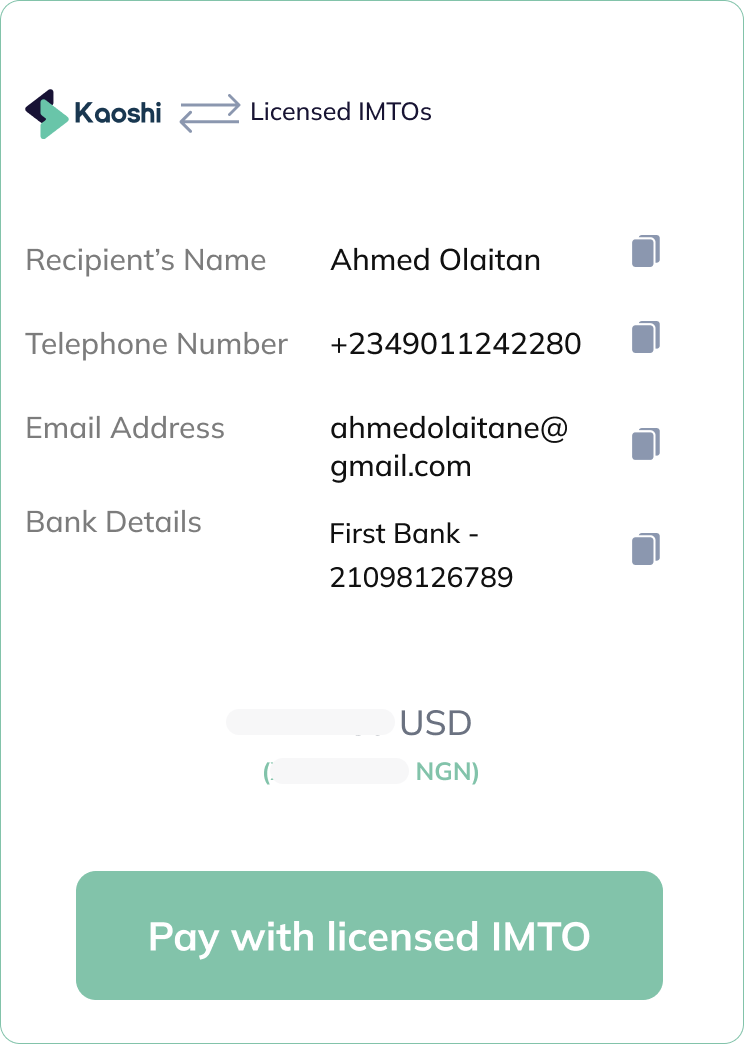

Tolu completes the transfer to a Nigerian domiciliary account

- Tolu is prompted to make a USD payment to Ahmed’s Nigerian domiciliary account via his preferred licensed IMTO like Worldremit, Ria Money Transfer and Remitly

- To complete the transfer, Tolu copies Ahmed’s details (as displayed) and is redirected to the licensed IMTOs page, where he is prompted to make the payment

Step 3

- Kaoshi verifies the payment and payment amount

- Ahmed receives his (inflow) US dollars in his domiciliary account

- As soon as Ahmed receives the US dollars in his domiciliary account, the bank moves the naira on hold in Ahmed’s naira account to Tolu’s mom’s account.

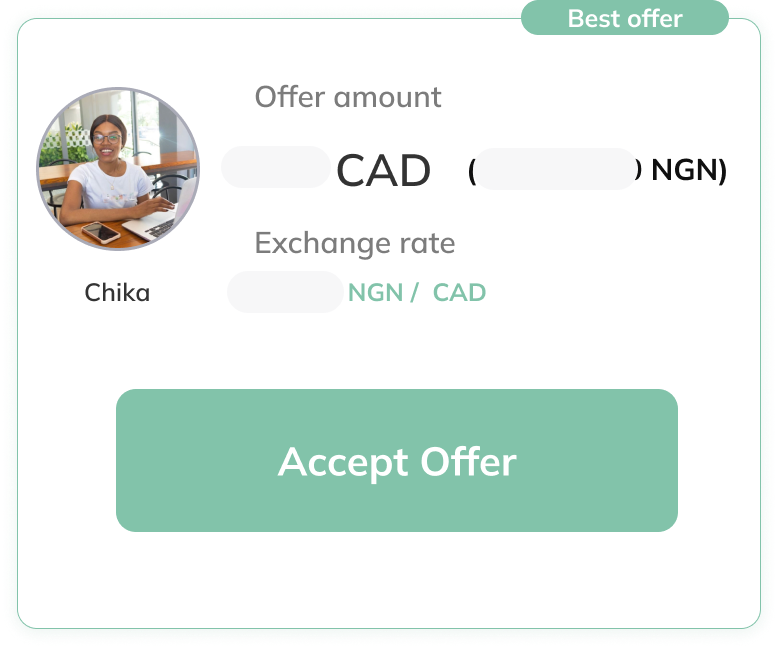

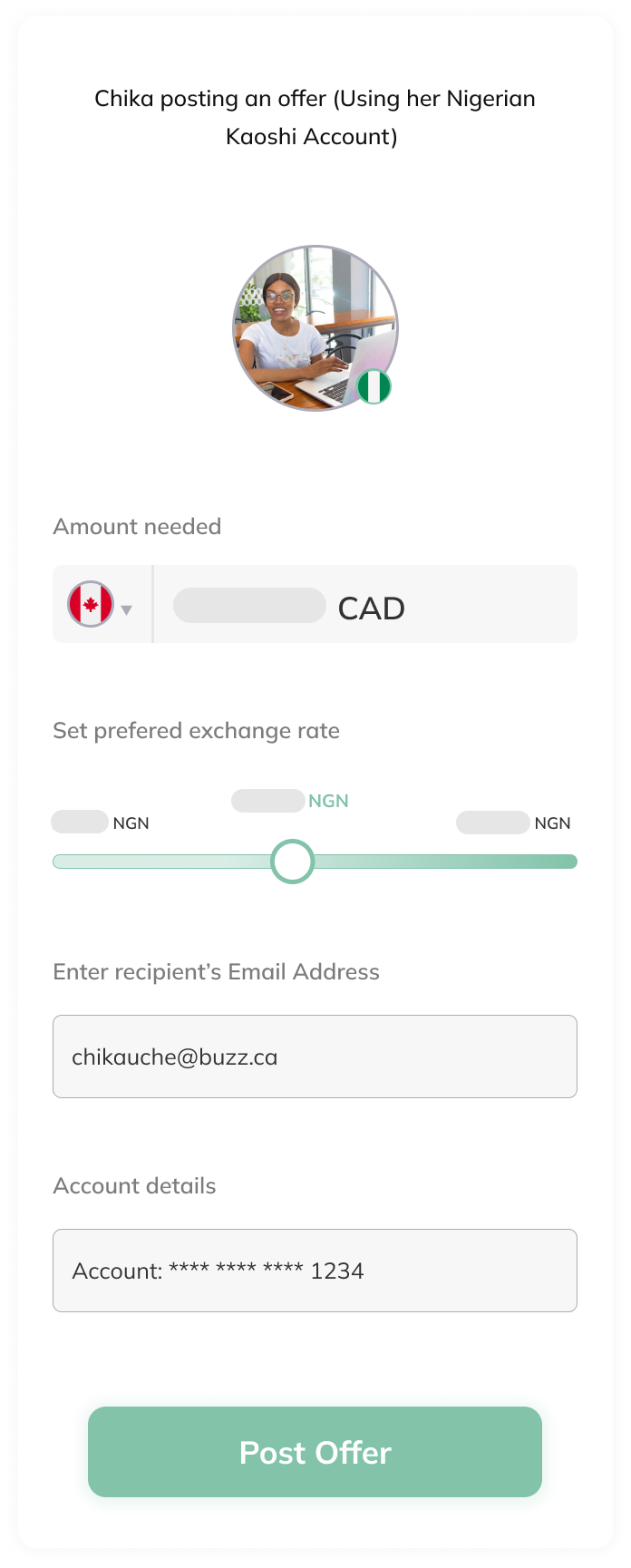

A poster user, Chika intends on exchanging her Naira from her Nigerian bank account for Canadian Dollars into her canadian bank account.

Step 1

Chika starts by posting an offer with her Nigerian account then she gets matched to a user that accepts her offer.

- She specifies the CAD amount she needs

- Sets preferred exchange rate

- Enters the email address of her second Kaoshi account (the Canadian one) where she will be receiving her CAD

- Chika’s bank places a fund hold on her naira account for the naira amount till the transaction is completed.

- Chika’s posting limit is 1000 CAD per transaction, but she can make multiple transactions daily.

- Unmatched offers expire after 24 hours and the fund hold is released on Chika’s naira account for the aforementioned naira amount.

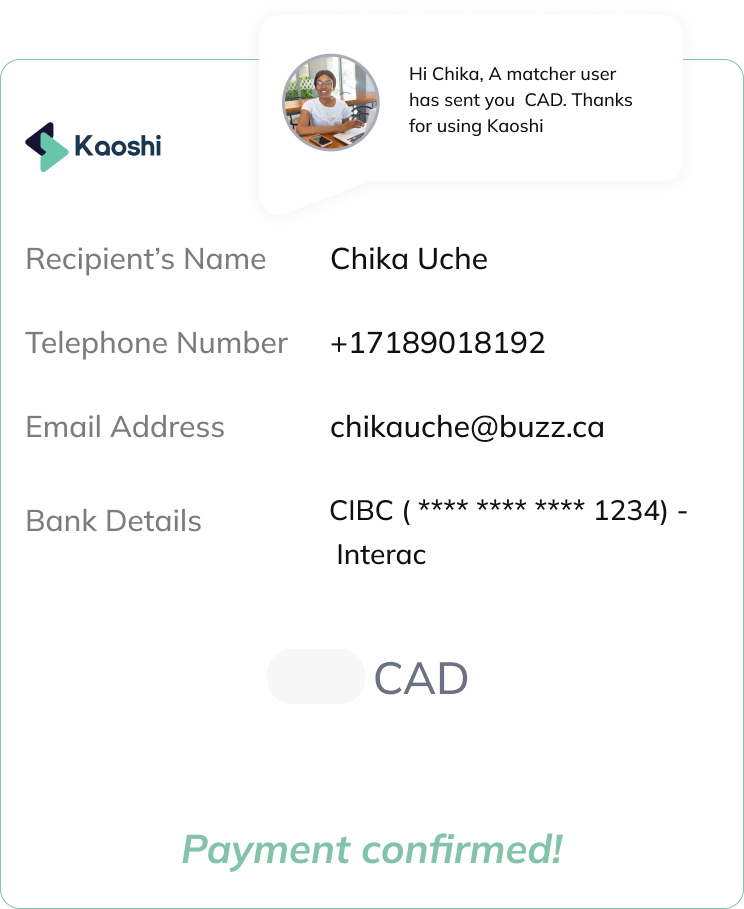

Step 2

Offer getting matched

Chika’s offer is then matched to a user who accepts her offer.

- The user that matched Chika’s offer is then prompted to make the payment to Chika’s Canadian bank account

- Kaoshi verifies the payment and payment amount

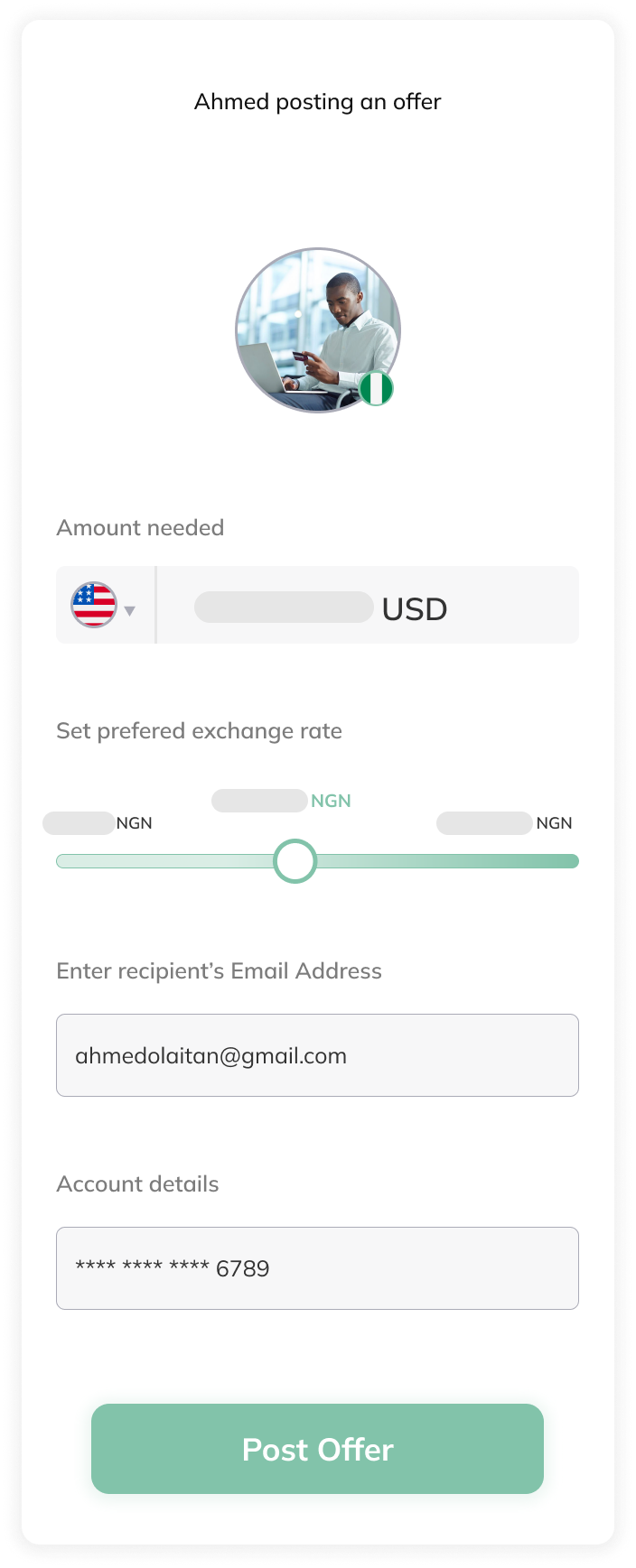

A poster user, Ahmed intends on exchanging his Naira from his Nigerian bank account for US Dollars into his local domiciliary account.

Step 1

Posting an offer (Poster 2)

Ahmed starts by posting an offer with his Kaoshi account then he gets matched to a user that accepts his offer.

- Specifies the US dollar amount he needs

- Sets preferred exchange rate

- Enters his Kaoshi email address as the recipient

- Ahmed’s bank places a fund hold on his naira account for the naira amount till the transaction is completed.

- Ahmed’s posting limit is 1000 USD per transaction, but he can make multiple transactions daily.

- Unmatched offers expire after 24 hours and the fund hold is released on Ahmed’s naira account for the aforementioned naira amount.

- Although Ahmed’s offer is a request for USD in his domiciliary account, his offer is broadcast to everyone across the globe, and not just to Kaoshi users in the USA. For his offer to be accessible globally, it is automatically converted to the local currency of each country it is broadcast to – by licensed international money transfer operators (IMTOs) on Kaoshi like Worldremit, Ria Money Transfer or Remitly.

Step 2

Offer getting matched

Ahmed offer is then matched to a user who accepts his offer.

- A matcher is prompted to make a USD payment to Ahmed’s Nigerian domiciliary account via his preferred licensed IMTO like Worldremit, Ria Money Transfer and Remitly

- To complete the transfer, the Matcher user copies Ahmed’s details (as displayed) and is redirected to the licensed IMTOs page, where he is prompted to make the payment

Send money from 40 countries to Nigeria and Ghana

Australia

Austria

Belgium

Bulgaria

Canada

Croatia

Czech Republic

Denmark

Estonia

Finland

France

Germany

Gilbratar

Greece

Hong kong

Hungary

Iceland

Ireland

Italy

Japan

Lativa

Lithuania

Luxembourg

Malaysia

Malta

Netherlands

New Zealand

Norway

Poland

Portugal

Romania

Singapore

Slovakia

Slovenia

Spain

Sweden

Switzerland

United Kingdom

United States

Send money internationally from Nigeria and Ghana to 14 countries

Austria

Belgium

Canada

Denmark

Finland

France

Germany

Italy

Netherlands

Portugal

Spain

Sweden

United Kingdom

United States